Apple first announced its plan to create a buy now, pay later option for the Apple Wallet in July 2021, but it was not until this week that the service officially launched.

Apple Pay Later permits U.S. shoppers to split purchases — retail, ecommerce, in-app — into four, interest-free payments. The service could encourage some shoppers to make purchases sooner, which, in turn, might boost both omnichannel retail and ecommerce.

In its release, the company said its new BNPL service was created “with users’ financial health in mind,” adding:

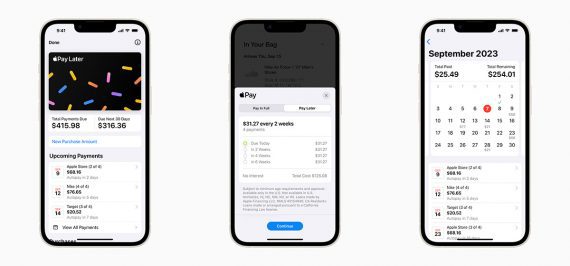

Apple Pay Later allows users to split purchases into four payments spread over six weeks with no interest or fees. Users can easily track, manage, and repay their Apple Pay Later loans in one convenient location in Apple Wallet. Users can apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases made on iPhone and iPad with merchants that accept Apple Pay.

Users can track, manage, and repay their Apple Pay Later loans in Apple Wallet. Click image to enlarge. Source: Apple.

Merchants already accepting Apple Pay need no additional action — the BNPL option should work automatically. Merchants on Shopify, BigCommerce, and other platforms can turn on Apple Pay.

Apple’s BNPL Advantage

Apple Pay Later could offer four significant advantages for shoppers compared to other services.

Massive user base. By some estimates, nine out of 10 physical retail locations in the United States accept Apple Pay. Moreover, roughly 48% of U.S. smartphones are Apple devices. Bottom line, Apple’s massive user base could rapidly enable significant market share in the BNPL space.

Trusted brand. Many consumers might pick Apple Pay Later over other providers or use BNPL for the first time because they trust the Apple brand and its reputation for delivering secure, quality products and services.

Easy to access. The service is available in Apple Wallet. Shoppers can apply for new loans, track outstanding loans, and manage repayment in an app they already have. Once the shopper has added it, Pay Later should be ready for purchases.

Inexpensive. The service does not charge interest and has no fees if the shopper remits on-time payments. Even folks flush with cash might consider taking out an interest-free, $1,000 loan now and again. A shopper’s own bank may charge, for example, a debit fee, but Apple Pay Later itself is cheap.

Impact

The launch of Apple Pay Later could prompt qualified shoppers to try the service, creating a short-term bump in sales.

Interested merchants should first make sure they can accept Apple Pay. Most ecommerce platforms allow sellers to accept Apple Pay and display its button.

Sellers can tout Apple Pay Later — particularly to shoppers on an iPhone — and the convenience of splitting purchases into interest-free installments. Promotional options could include a banner on checkout pages or even an embedded video demonstrating how to use the service or, for that matter, other BNPL providers.

There is also the opportunity to leverage Apple’s brand. By offering Apple Pay Later, merchants could benefit from the trust and loyalty associated with the company. This association could build credibility — fostering trust and encouraging repeat purchases, as shoppers know they are working with Apple.

Ultimately, merchants may not know definitively if Apple Pay Later drives new or sooner sales. Nonetheless, there’s no downside to promoting it.